The Only Guide to Hard Money Georgia

Wiki Article

The smart Trick of Hard Money Georgia That Nobody is Discussing

Table of ContentsThe 6-Second Trick For Hard Money GeorgiaHard Money Georgia - The FactsSome Of Hard Money GeorgiaAn Unbiased View of Hard Money Georgia

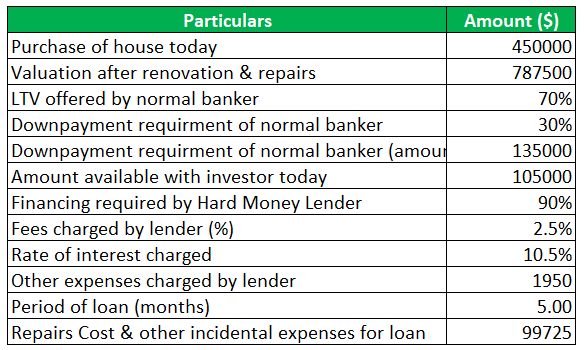

Since tough cash finances are collateral based, likewise referred to as asset-based loans, they call for very little documentation and also enable investors to shut in an issue of days. Nevertheless, these car loans featured more threat to the lending institution, as well as for that reason require greater deposits and also have higher rate of interest than a conventional loan.In enhancement to the above break down, tough money finances and standard mortgages have other distinctions that distinguish them in the minds of capitalists and loan providers alike: Tough cash fundings are moneyed much faster. Numerous traditional fundings might take one to two months to close, however tough cash car loans can be enclosed a couple of days.

Many difficult cash financings have brief repayment periods, typically between 1-3 years. Standard home mortgages, in comparison, have 15 or 30-year repayment terms on average. Tough cash lendings have high-interest prices. A lot of difficult cash financing rates of interest are anywhere between 9% to 15%, which is significantly more than the interest rate you can anticipate for a typical home mortgage.

As soon as the term sheet is signed, the loan will certainly be sent to handling. During finance processing, the lending institution will ask for files and also prepare the funding for final finance review and also schedule the closing.

Fascination About Hard Money Georgia

Fundamentally, due to the fact that individuals or companies offer tough money fundings, they aren't based on the very same guidelines or limitations as financial institutions and also debt unions. This means you can get special, directly customized tough cash loans for your particular requirements. That stated, difficult money financings have some disadvantages to keep in mind before seeking them out.You'll need some capital upfront to receive a hard money funding as well as the physical property to act as security. This can make tough cash financings hard to reach for some investors or homeowner. On top of that, tough cash finances normally have greater rate of interest rates than conventional mortgages. They are also interest-only loans which means your month-to-month repayment only covers interest and also the primary quantity will schedule at maturation as a lump sum.

Common leave techniques consist of: Refinancing Sale of the asset Payment from other source There are many circumstances where it might be beneficial to make use of a tough money financing. For starters, actual estate investors that such as to house flip that is, buy a rundown house in demand of a lot of work, do the work directly or with professionals to make it a lot more valuable, then reverse and offer it for a greater rate than they purchased for might locate hard money finances to be ideal funding choices.

As a result of this, professional house flippers normally like temporary, busy financing services. On top of that, home fins generally attempt to sell homes within less than a year of acquiring them. Since of this, they do not require a long-term and also can stay clear of paying way too much interest. If you purchase investment homes, such as rental buildings, you might additionally locate difficult cash finances to be excellent selections.

The Only Guide for Hard Money Georgia

In some instances, you can also utilize a tough cash finance to buy uninhabited land. Note that, even in the above circumstances, the potential downsides of tough money finances still use.

Hard cash car loans generally come with greater interest prices and much shorter repayment routines. Why choose find out a difficult cash finance over a conventional one?

Some Of Hard Money Georgia

Furthermore, since personal individuals or non-institutional lenders offer hard cash loans, they are exempt to the very same laws as standard loan providers, which make them much more risky for borrowers. Whether a tough cash funding is best for you depends upon your situation. Tough cash fundings are great options if you were refuted a standard funding and need non-traditional funding.Contact the expert home loan advisors at Right Beginning Home Loan. hard money georgia for more details. Whether you wish to buy or re-finance your house, we're here to aid. Start today! Ask for a totally free personalized price quote.

The application process will commonly include an assessment of the property's value and also capacity. That way, if you can't manage your repayments, the tough money lending institution will helpful resources simply continue with offering the residential or commercial property to recover its investment. Difficult cash lenders commonly charge greater rate of interest than you would certainly carry a conventional financing, but they likewise money their car loans faster as well as generally require much less documentation.

Instead of having 15 to three decades to pay off the loan, you'll usually have simply one to five years. Hard money financings work quite in a different way than standard loans so it is necessary to comprehend their terms and also what purchases they can be used for. Hard money fundings are commonly planned for investment homes.

Report this wiki page